Are you looking to build wealth through everyday savings? This comprehensive guide reveals proven strategies that can help you save thousands of dollars annually without sacrificing your lifestyle. Learn how small, strategic changes in your daily routine can lead to significant financial gains.

Smart Strategies for Daily Savings

Small, consistent savings can make a big difference over time. Here are ten proven ways to save money on everyday expenses:

1. Cook at Home

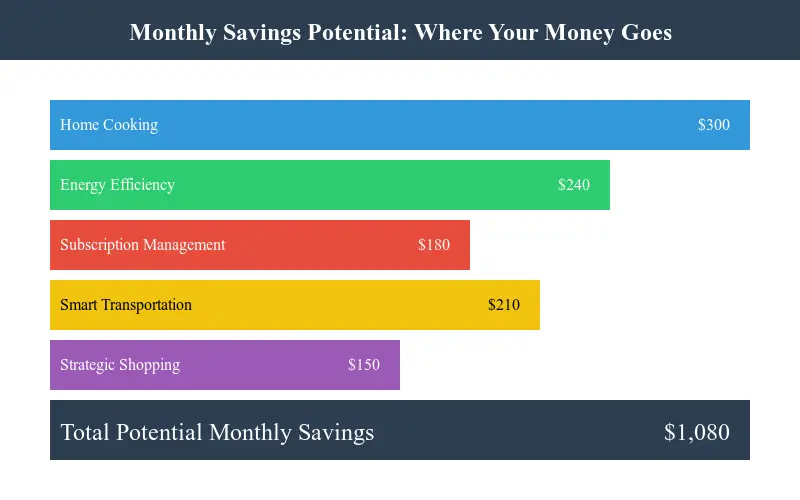

Your kitchen isn’t just a place to prepare meals—it’s your personal money-saving headquarters. Start with meal planning and batch cooking to maximize both time and savings. Prepare larger portions of staple dishes on weekends, then portion them out for quick weekday meals. This strategy not only saves money but also reduces the temptation to order takeout after a long day.

2. Use Coupons and Cashback Apps

Today’s cashback and coupon apps can transform everyday purchases into opportunities for savings. Try some apps that can help you earn cashback or find discounts on everyday purchases.

3. Optimize Energy Usage

Your utility bills offer surprising opportunities for savings. Small changes in energy usage can lead to significant financial benefits:

- Leverage natural light and temperature control

- Install a smart thermostat to optimize heating and cooling

- Replace old appliances with energy-efficient models

- Use power strips to eliminate phantom energy drain

4. Cut Subscription Services

Take control of your recurring expenses. The average household spends over $200 monthly on subscription services, often paying for unused memberships. Conduct a monthly subscription audit and consider these alternatives:

- Bundle services for better rates

- Share streaming services with family members

- Rotate between different services seasonally

- Use free alternatives when available

5. Shop Second-Hand

Buy clothes, furniture, and electronics from thrift stores or online marketplaces. This is eco-friendly and cost-effective.

6. Carpool or Use Public Transport

Transportation costs can eat up a significant portion of your budget. Consider these money-saving alternatives:

- Maintain your vehicle properly to prevent costly repairs

- Explore carpooling options with colleagues

- Use public transportation for regular commutes

- Walk or cycle for short trips

7. Avoid Impulse Buying

Understanding the psychology behind spending helps you make better financial decisions. Implement these mental strategies:

- Celebrate saving milestones to maintain motivation

- Use the 24-hour rule for non-essential purchases

- Keep a “want list” with dates—you’ll often find items becoming less appealing over time

- Track your spending to identify emotional purchasing patterns

8. Take Advantage of Discounts

Many people leave money on the table by not taking advantage of available discounts:

- Loyalty program benefits

- Student, senior, and military discounts

- Professional association memberships

- Seasonal sales and clearance events

9. Plan Grocery Trips

Transform your grocery shopping from a budget drain into a savings opportunity:

- Shop with a detailed list organized by store layout

- Buy non-perishables in bulk during sales

- Compare unit prices rather than package prices

- Use store loyalty programs effectively

10. Set Savings Challenges

Make saving money engaging and fun with structured challenges:

- Set specific monthly saving goals

- Try a no-spend weekend each month

- Participate in the 52-week savings challenge

- Create a “save the change” digital jar

Remember, successful saving isn’t about deprivation—it’s about making smarter choices with your money. Every dollar saved is a step toward greater financial freedom. Start implementing these strategies today, and watch your savings grow over time.

Want to maximize your savings potential? Share these tips with friends and family to create a supportive money-saving community. Together, you can encourage each other to reach your financial goals and celebrate your successes along the way.